The Carry weighted vest is HSA and FSA eligible

Use your Health Savings Account (HSA) or Flexible Spending Account (FSA) to checkout with pre‑tax dollars—thanks to our integration with Flex.

Shop Eligible Products

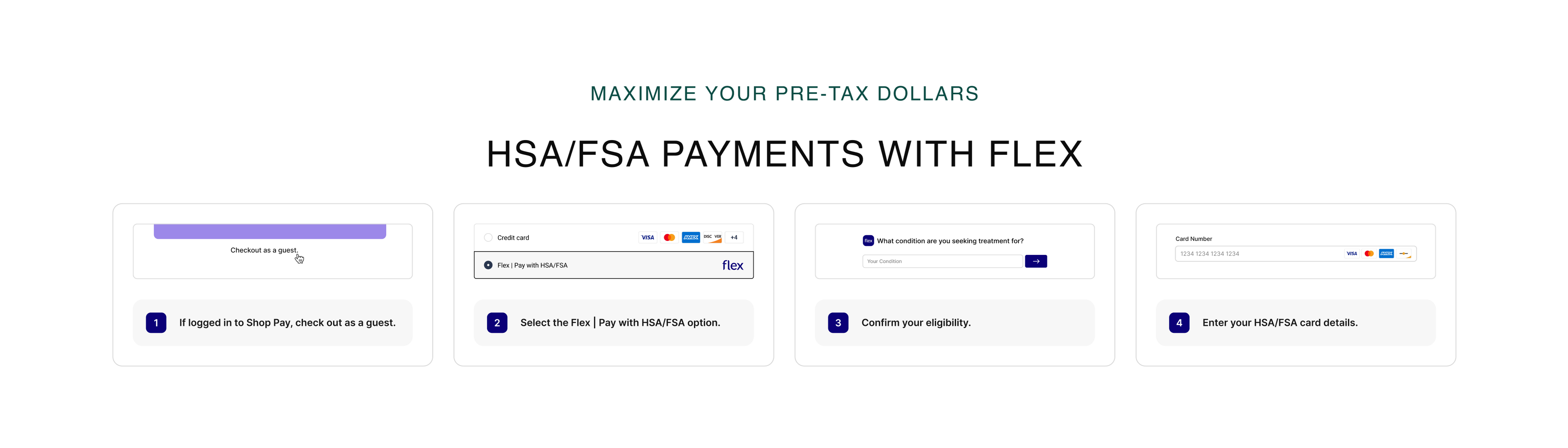

How it Works

How to Pay with Your HSA/FSA

- Shop as usual: Add any of our weighted products to your cart.

- Select payment method: Choose Flex | Pay with HSA/FSA at checkout. (Make sure you check out as a guest)

- Enter your card details: Input your HSA or FSA card (or a regular card if you’ll submit for reimbursement later).

- Receive documentation Within 24 hours, Flex will email you an itemized receipt and a Letter of Medical Necessity (if needed)—keep these for reimbursement or records.

Optional telehealth validation available if needed.

Eligibility Requirements

Who Can Use HSA/FSA Funds?

- Your purchase must help treat or manage a medical condition, as defined by the IRS.

- You may need a Letter of Medical Necessity (LOMN) to confirm eligibility.

- Flex automates the creation of your LOMN to make this part quick and easy.

Note: HSA and FSA rules can vary slightly depending on your account, so be sure to check what’s covered.

Save 30-40% Using Pre‑Tax Dollars

By paying with HSA/FSA funds, you benefit from tax savings—generally between 30% and 40%, depending on your tax bracket.

Frequently asked questions

What is an HSA or FSA and what are the benefits?

An HSA (Health Savings Account) and FSA (Flexible Spending Account) are U.S.-based, tax-advantaged accounts used to pay for qualified medical expenses.

HSAs are available to those with a high-deductible health plan and offer more flexibility, allowing funds to roll over annually. FSAs, employer-sponsored, allow employees to use pre-tax dollars for medical expenses such as prescriptions and copays, but typically feature a "use-it-or-lose-it" policy where funds must be used within the plan year.

Please note: HSA and FSA accounts are part of the U.S. healthcare and tax system, and this benefit is currently available to U.S. customers only.

How do I pay with my HSA or FSA card?

To use your HSA or FSA debit card, add products to your cart as usual. At checkout, select “Flex | Pay with HSA/FSA” as your payment option, enter your HSA or FSA debit card, and complete your checkout as usual. If you don’t see “Flex | Pay with HSA/FSA,” you may be in Shop Pay. Select “checkout as guest” to view more payment options.

What if I don’t have my HSA/FSA card available?

If you don’t have your HSA or FSA card handy, still select “Flex | Pay with HSA/FSA” as your payment method. Enter your credit card information and Flex will email you an itemized receipt to submit for reimbursement.

Why isn’t the HSA/FSA option showing at checkout?

If you were prompted to enter a verification code when logging in or at checkout, you’re likely using ShopPay.

ShopPay is Shopify’s express checkout option that lets you use your saved profile information across any Shopify-powered store. It speeds up the checkout process by skipping most of the standard steps.

Want to Use Your HSA/FSA with Flex?

If you’d prefer to check out using Flex to apply your HSA or FSA card, you’ll need to exit ShopPay. Here’s how:

- On the ShopPay screen, scroll to the bottom.

- Select “Check out as guest.”

- This will redirect you to the standard checkout process, where you can select Flex as your payment method.

What if my HSA/FSA card gets declined?

HSA/FSA cards are debit cards, and the most common reason for declines is insufficient funds. Reach out to your HSA/FSA administrator to confirm your balance. Flex will prompt corrections if the decline is due to incorrect card data.

Is sales tax covered by HSA/FSA funds, or is it treated separately?

Yes, sales tax for eligible items is also covered by HSA/FSA funds.

I already pre‑ordered—can I still use my HSA/FSA?

Yes! If you’ve already pre‑ordered using a personal card, you may still be able to request reimbursement through your HSA or FSA provider.

Just note: reimbursement is subject to your provider’s rules and eligibility criteria, and a Letter of Medical Necessity may be required.

What is a Letter of Medical Necessity and do I need to do anything with it?

It’s essentially a signed note from a doctor stating that you are purchasing an item to treat or manage a medical condition. Flex may assist in issuing it. You should keep it on file for at least three years in the event of an IRS audit of your HSA or FSA account. Occasionally, FSAs may ask for the letter (LOMN) to confirm the eligibility of your purchase.

I submitted my Flex itemized receipt for reimbursement and my FSA requires more information.

Please forward the request from your FSA to support@thecarry.co and we will work with the Flex team to issue you a new receipt.

Help! I didn't receive an email from Flex with my itemized receipt and/or letter of medical necessity. What should I do?

Please check your spam folder, as sometimes emails from notifications@withflex.com may be automatically filtered as spam by some email service providers. If you still can’t find it, please email support@withflex.com and let them know the email address associated with your order.

My HSA/FSA claim was denied. What should I do?

We strongly recommend checking with your HSA/FSA provider to see if a purchase is eligible prior to completing the purchase. However, if you believe your claim has been wrongly denied, please send over any response from your HSA/FSA provider to us so we can share it with Flex and receive guidance on the next best steps to take. Please note that employer-sponsored FSAs can determine what products are eligible beyond the IRS’s guidelines, so it’s extremely important to check prior to purchase.

What is Flex and what is their relationship with The Carry?

The Carry has partnered with Flex to allow you to use your Health Savings Account (HSA) or Flexible Spending Account (FSA). This means you can now use your HSA or FSA debit card to purchase any of our products with pre-tax dollars, resulting in net savings of 30-40%, depending on your tax bracket.